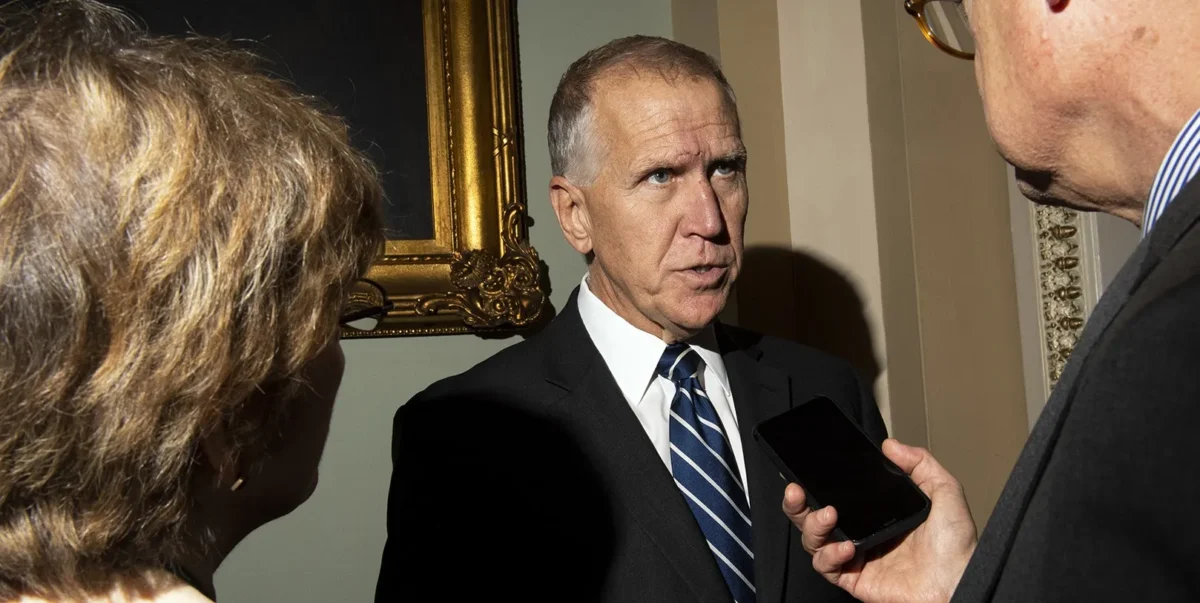

Sen. Tillis Bill Has Far-Reaching Impact on Corporate Lending Beyond Litigation Finance

June 18th, 2025

- Chapter 50B of the Senate Finance Committee’s Reconciliation Bill (Senate Finance Committee Press Release) proposes a uniform 40.8% tax on any bank or private loan that has an interest rate above 8.8% and that is secured, in whole or in part, by a legal claim.

- While the proposal’s title suggests it targets “litigation financing”, it defines such agreements so broadly that it will likely have unintended consequences felt by the entire U.S. corporate lending market and double the tax rate applicable to a wide variety of investments that extend far beyond litigation finance, including:

- Secured loans to companies with legal claims of any kind;

- Loans to bankrupt companies, allowing them to operate and keep people employed while they restructure;

- Structured financial products (such as government securitizations that are critical to home mortgages) that use pass-through entities to hold collateral and initiate foreclosure proceedings; and

- Investments in insurance companies that are secured by recoveries in subrogation claims.

- On its terms the provision applies to any financing agreement “with respect to any civil action . . . whereby a third party agrees to provide funds to one of the named parties . . . which creates a direct or collateralized interest in the proceeds of such action . . . based, in whole or in part, on a funding-based obligation to . . . such civil action.” As written, the provision would apply regardless of whether the potential litigation proceeds represent only a fraction of a broader corporate investment that is not otherwise impacted by litigation recoveries, such as an “all assets” corporate loan. The net effect will be that U.S. corporates will see the cost of borrowing rise significantly, to the extent credit is available at all.

- The provision further imposes this 40.8% tax at the entity level, disregarding decades of settled U.S. tax law and undermining the long-standing principle that pass-throughs like partnerships and LLCs shouldn’t be taxed at the entity level. If enacted, the bill would disproportionately impact certain U.S. tax-exempt investors, such as pension funds, university endowments, and religious organizations.

The proposed legislation was first introduced to the Senate less than a month ago and was crammed into the Reconciliation Bill without a hearing on the proposal or opportunity to highlight these fundamental concerns, which would likely have a chilling impact on the broader corporate lending and structured finance market.